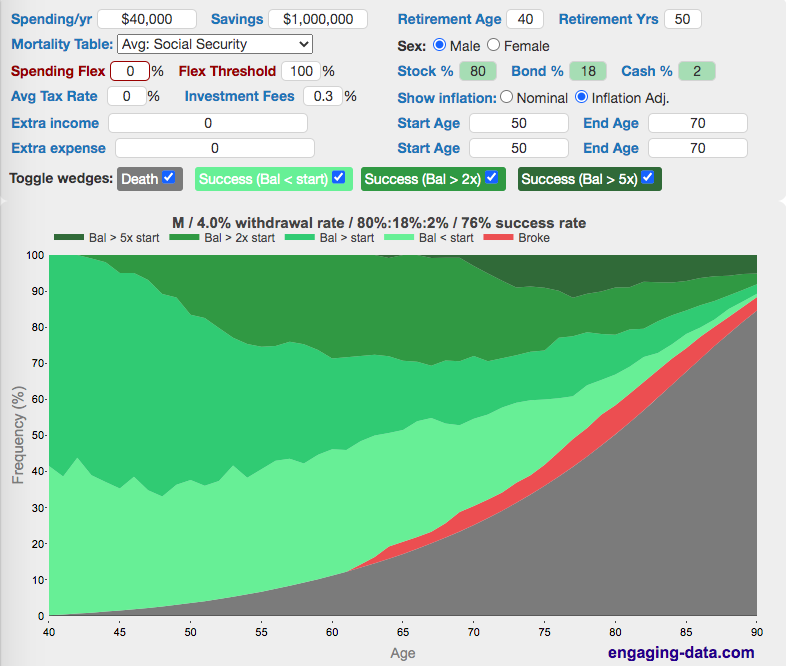

Work out how much youll need to save for retirement on top of. Our Retirement Savings Calculator generates a retirement analysis graph that illustrates your potential retirement balance and withdrawals as you age. You’ll have options for entering the information you’d expect, such as your age and how much you’ve already saved and invested toward retirement. It works whether you’re early in the retirement savings mode, or already retired. The result will also be based on your gender, retirement age, current health, and pension fund, so make sure that you take the time to enter these as accurately as possible when you begin. Use the Sorted retirement calculator to find how much youll need to retire in New Zealand. Rowe Price calculator offers a straightforward and simple retirement planning tool. It's important to understand that the figures that we provide you with are for illustrative purposes only. Once you click the 'Calculate risk' button, you can change the amount of income that you might take from income drawdown.īy looking at your retirement income needs, the tool will then calculate how likely you are to run out of money in retirement. Use this calculator to determine how long those funds will last given regular withdrawals. This Retirement Drawdown Calculator will help you to get an idea of how long your portfolio will last after you retire.

#RETIREMENT DRAWDOWN CALCULATOR FREE#

Start by adding your total pension fund (after you have deducted any tax free and taxable cash lump sums). You have worked hard to accumulate your savings. It will base the response on whether you're in excellent, reasonable, challenging or critical health. Our investment withdrawal calculator is designed to help you see how long your retirement savings will last. Our Drawdown Risk Calculator will help you to compare the income that you would receive from an annuity, with the same level of income taken with income drawdown. Once you've used the tool you can save and print out your results to refer to later on if you wish. Income drawdown allows you to access your pension savings as and when you want, but as with all investments, there are risks involved. Since the pension freedoms in April 2015, more and more people are looking for more flexible ways to invest their pension savings.

0 kommentar(er)

0 kommentar(er)